wiSource Local is a Leading Expert in Payments

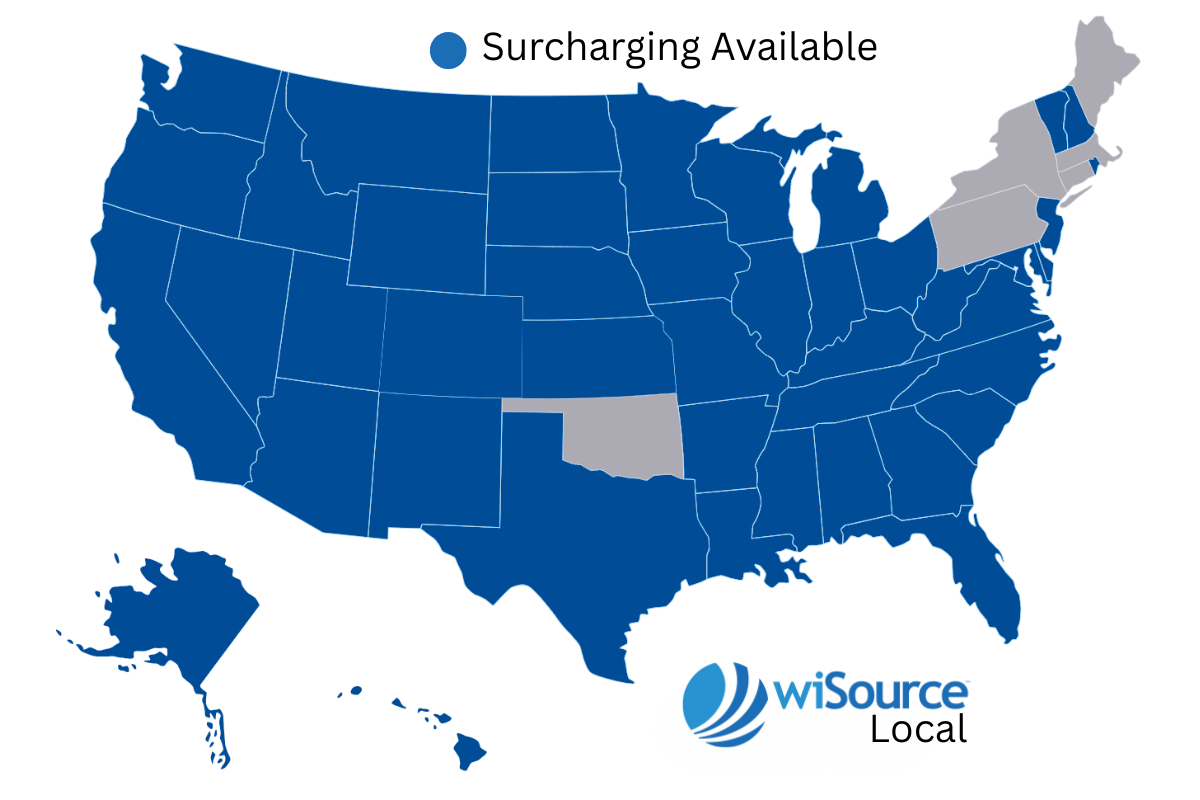

You get the benefit of leading experts who turn a complex, fast-moving payments landscape into clear, state-by-state guidance you can use today. From surcharging rules and cash-discount programs to PCI compliance, tax considerations, and card-brand requirements, we translate regulations into practical steps for your location. You see exactly what’s allowed, what’s changing, and how to implement it without guesswork. Explore the states we serve to find tailored playbooks, setup checklists, and proven policies that keep you compliant while improving your bottom line.

wiSource Local has the Card Brand Rules Covered

You have the card-brand requirements handled from day one. Passing credit card fees to payers means following the contractual rules set by Visa, Mastercard, Discover, and American Express as a condition of accepting their cards. With Strictly, you get a turnkey setup that aligns with those rules, including required advance notice and registration where applicable, correct receipt and invoice disclosures, permitted fee caps, and support for excluded categories and locations. The platform enforces compliant prompts at the terminal and online checkout, applies the right fee logic by card type, and keeps audit records for your files. You focus on getting paid; the system keeps you inside the lines.

The Regulations

You must register with the card brands before assessing a credit card fee, typically through your payment processor or acquiring bank.

You must notify customers of the fee with clear signage at the store entrance, at the point of sale, and on the checkout page for online payments.

You must cap the credit card fee at 3 percent and may not profit from it; the fee should not exceed your effective processing cost.

You must process the product or service amount and the credit card fee together in a single transaction.

Your receipt must itemize the credit card fee as a separate line.

You must not apply a fee to debit card transactions, including PIN and signature debit.

We handle all of this for you, pain free.

Our Solution

You get end-to-end brand registration handled for you. Our team completes every required step with the card brands through your processor or acquirer and confirms when you are cleared to surcharge.

You receive compliant signage and disclosures. We provide entrance, point-of-sale, and online checkout notices so customers stay informed and you stay aligned with brand and state requirements.

You control a compliant surcharge rate. Our Variable Rate Surcharging™ lets you set a surcharge up to your effective processing cost, automatically capped at 3 percent and calibrated so you do not profit from the fee.

You process the fee and sale together. The platform combines the purchase amount and the credit card fee in a single, seamless authorization and settlement.

You issue itemized receipts automatically. Every receipt displays the surcharge as a separate line with the amount and rate, meeting brand documentation rules.

You avoid fees on debit, automatically. The system detects PIN and signature debit, applies no surcharge, and routes the transaction through the lowest-cost compliant path.

In addition, with wiSource Local you also will gain free access to LocalTru™ Benefits:

- Stop wasting hours searching for reliable local vendors! Gain access to a curated directory of trusted local suppliers and service providers (IT support, office supplies, shredding services, cleaning crews, etc.) recommended by your fellow local merchants. We’ll even negotiate group discounts where possible.

- Got a tricky software question, a compliance concern (like HIPAA or local regulations), or need advice on handling a unique office situation? Our private online forum allows you to tap into the collective wisdom of experienced local merchants and occasionally features Q&A sessions with local experts (e.g., HR consultants, IT specialists, legal advisors – perhaps via a quarterly webinar).

- Join us for an annual high-value workshop focused on skills directly relevant to your role – think mastering new office technology, local marketing insights for small practices, streamlining merchants workflows, or updates on crucial local/state regulations affecting your industry (dental, vet, legal). This is your chance to gain practical knowledge and connect with peers face-to-face.

- Access a members-only online library of customizable templates, checklists, and best-practice guides relevant to various merchants tasks and specific to the needs of dental, vet, legal, and other small offices. Share your successes and learn from others.

- Connect with a smaller group of merchants specifically within your field (e.g., a dental office group, a vet clinic group, etc.). While the main association meets rarely, these mini-networks can choose to connect more often virtually or for informal local coffee chats if they wish, to discuss highly specific industry challenges and solutions.

- Be part of a recognized local group that understands the unique pressures and contributions of merchants in our community. Even without frequent meetings, this association provides a sense of belonging and a network of local peers you can rely on.